Okay, let’s get into how climate change is really shaking things up in the property world here in the US. I remember talking to a friend who owns some coastal real estate, and they were telling me how their insurance premiums just jumped stratospheric levels almost overnight. It wasn’t just a small increase; it was a fundamental shift in how insurers view the risk of owning property in that specific spot. This isn’t an isolated incident; it’s a growing trend that signals a much larger force at play. Understanding Climate Change & Its Effect on Property Markets is no longer just an environmental concern; it’s becoming a core part of strategic business planning for anyone involved in real estate, from investors and developers to insurers and lenders. We’re seeing shifts in risk profiles, market values, and even where people choose to live, all influenced by a changing climate.

The Rising Tide and Burning Landscapes: Direct Climate Impacts

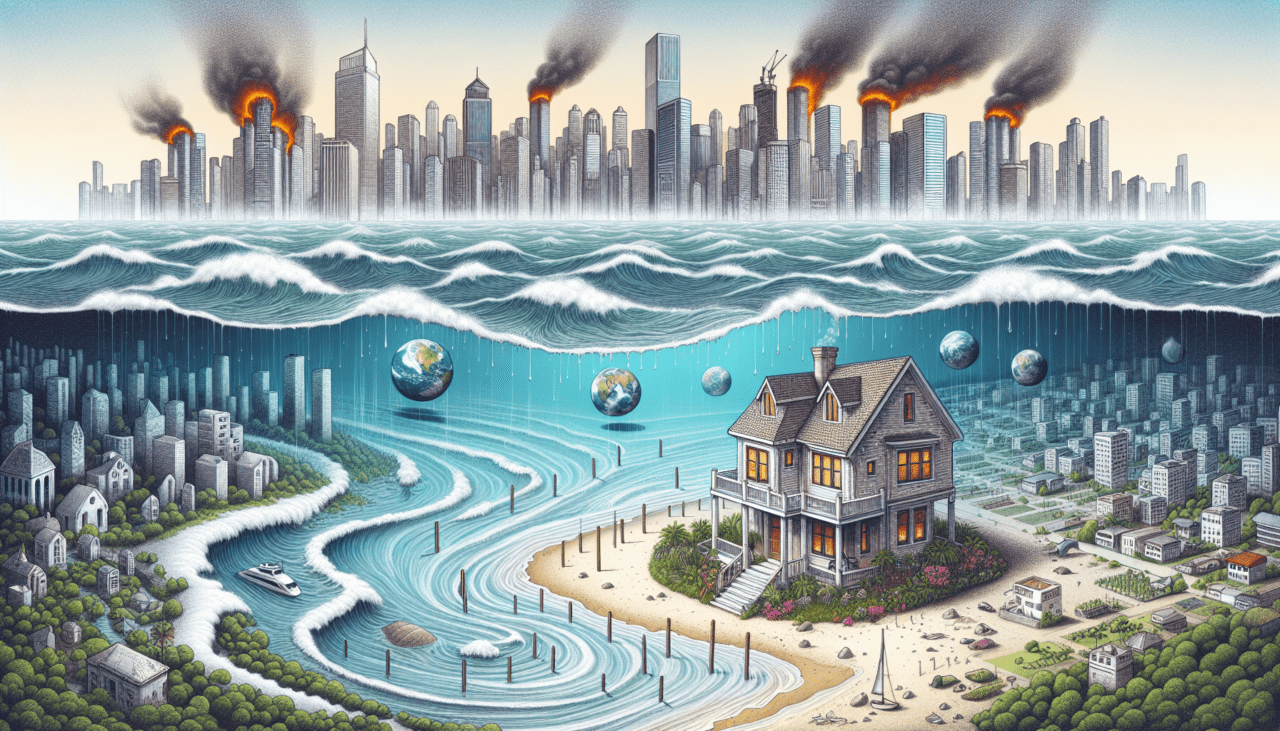

When we talk about climate change impacting property, the most immediate thought often goes to physical damage. We’re witnessing extreme weather events becoming more frequent and intense. Think about the superstorms, the relentless wildfires in the West, or the increasing severity of flooding along rivers and in urban areas after heavy rainfall. These events don’t just cause temporary disruption; they can inflict significant, lasting damage that directly affects the value and insurability of a property. It’s about more than just cleanup costs; it’s about the long-term viability and financial risk associated with owning assets in vulnerable locations. The footprint of where climate risks are significant is definitely expanding.

Coastal and Flood Zone Vulnerability

Let’s start with the coastlines. Sea-level rise is a reality, and it’s accelerating. This means coastal properties face increased risks from storm surges, king tides, and gradual coastal erosion. It’s not just properties right on the beach either; areas near estuaries and low-lying coastal plains are also increasingly vulnerable to inundation. In flood zones, the maps are being redrawn, reflecting higher risks due to changing precipitation patterns and overwhelmed infrastructure. Lenders and insurers are paying close attention to these maps, and it’s influencing everything from mortgage availability to insurance costs, making some areas incredibly expensive or difficult to insure.

Wildfire and Heat Risk

Moving inland, the picture changes but the risk remains. Wildfire seasons are getting longer and more destructive, particularly in drought-prone regions. Properties previously considered safe are now within expanding wildfire perimeters, facing direct threat from flames and indirect damage from smoke and air quality issues. Beyond fires, extreme heat is becoming a major factor. Prolonged heatwaves stress infrastructure, increase energy costs (for cooling), and can even affect habitability and labor productivity. Investors are starting to look hard at these climate factors when assessing potential acquisitions, considering not just today’s risk but future projections.

Beyond the Damage: Financial and Market Ripple Effects

The physical damage from climate events is just one layer of the impact. Climate Change & Its Effect on Property Markets creates broader economic and financial consequences that reverberate through the entire system. It affects how property is financed, insured, valued, and even how people choose where to live. These are systemic risks that require a different level of analysis than traditional market cycles. It’s prompting a fundamental reassessment of what constitutes a ‘safe’ or ‘stable’ property investment over the long term. The interconnectedness of these risks is becoming increasingly clear to those in the financial sector.

Insurance and Lending Challenges

Perhaps the most visible ripple effect is in the insurance market. Insurers are risk-averse by nature, and as climate risks escalate, they are dramatically increasing premiums, reducing coverage, or pulling out of certain markets entirely. This directly impacts property owners but also prospective buyers, as property insurance is often a condition of mortgage lending. Lenders are becoming more cautious, increasingly incorporating climate risk assessments into their underwriting processes. In high-risk areas, obtaining insurance or a mortgage can become prohibitively expensive or even impossible, effectively stranding assets.

Changing Demand and Migration Patterns

As certain areas become more vulnerable or expensive to insure, we’re starting to see shifts in where people want to live and invest. This isn’t just hypothetical; communities are already grappling with relocation needs due to chronic flooding or fire risk. This potential “climate migration” could decrease demand and property values in high-risk zones while increasing pressure on infrastructure and housing in receiving areas often perceived as “safer” or more resilient.

- Areas facing chronic flooding or sea-level rise may see decreased long-term demand.

- Regions with escalating wildfire risk could experience similar devaluation trends.

- Areas less exposed to acute physical risks might see increased demand, potentially driving up property values.

- Consideration of water scarcity is also influencing desirability in some previously popular areas.

This dynamic creates both challenges and potential opportunities for real estate investors looking to understand future market dynamics.

Investing in Resilience: Strategies for a Changing Climate

The challenges posed by Climate Change & Its Effect on Property Markets aren’t insurmountable, but they require strategic thinking and proactive measures. The good news is that the market is beginning to adapt, and there’s a growing focus on resilience – building, retrofitting, and planning in ways that minimize climate risk. This isn’t just about protecting existing assets; it’s also creating new investment opportunities in green technologies, resilient infrastructure, and properties designed for the future climate. Investors who understand these trends can position themselves advantageously.

Adaptation and Mitigation Strategies

Property owners and developers are starting to implement adaptation measures. This can range from elevating structures and installing flood barriers in coastal or flood-prone areas to using fire-resistant materials and creating defensible space in wildfire zones. Investing in energy efficiency and on-site renewable energy also reduces reliance on potentially vulnerable power grids during extreme weather events and helps mitigate climate change itself. Retrofitting older buildings to be more resilient is becoming a significant business area.

Policy, Regulation, and Opportunities

Government policies are also evolving. We’re seeing changes in building codes to incorporate climate resilience, new regulations on flood plain development, and increased disclosure requirements for climate risks during property transactions. There are also incentives emerging for green building and resilient infrastructure projects. This regulatory landscape creates both compliance challenges and opportunities for investment. Businesses focused on developing or managing climate-resilient properties, providing climate risk assessment services, or specializing in resilient construction are finding a growing market.

- Government grants and tax incentives may support resilient construction or retrofits.

- Updated building codes are mandating higher standards for new developments.

- Increasingly, financial institutions are requesting detailed climate risk reports.

- Investing in climate-tech related to property (e.g., flood sensors, fire suppression systems) is an emerging area.

Navigating this landscape requires staying informed about evolving risks and understanding how policy and market forces are interacting.

So, what’s the takeaway for businesses navigating the property market today? It’s clear that climate change is not a distant threat; it’s a present reality that is already influencing property values, insurance costs, lending practices, and migration patterns across the US. Ignoring climate risk is no longer an option; it’s a critical component of due diligence and strategic planning. Businesses involved in real estate, from investors and developers to managers and insurers, need to integrate climate risk assessments into their core operations. This means evaluating not just current exposure but also future projections for specific locations. Consider investing in resilience measures, whether that’s retrofitting existing properties or developing new ones with climate resilience in mind. Stay informed about evolving regulations and market trends driven by climate change, as these will shape opportunities and risks for years to come. The property market is changing, and adapting to this new climate reality is essential for long-term success and stability.